Submission to the Australian Securities and Investments Commission (ASIC).

By Sean Butler, Perth, Western Australia [email protected] 0419 964 487

FTI Consulting Australian Directors fail to report contempt of Parliament.

Senior Managing Director lied to an Australian Senate Inquiry.

Senate Inquiry into the post GFC banking sector 2012

Bankwest managers involved and instructed the Receiver to "Sink Boots into Customer."

See the lying Corporate thug Bankwest / FTI Consulting manager squirm at the Senate Hearings Click LINK

In this video Mark Englebert requested his evidence be given "in camera" or in secret.. We found out several years later that he provided deliberately false and misleading evidence to the Senate Committee to prevent further investigation. This is contempt of Parliament and if prosecuted can carry a jail term.

As a result of widespread misconduct uncovered during the recent Australian Banking Royal Commission the Australian Government has increased funding to ASIC, appointed a new chairman of ASIC and broadened its powers of inquiry. ASIC now has a mandate to take legal action, to prosecute and to fine financial organisations found to have acted dishonestly. The public and political sentiment in Australia towards financial organisations has changed following damming evidence given to the Royal Commission. The public and politicians now want to see action on enforcement and prosecution to deter this sort of conduct. The case below could also result in Jail terms for some involved.

This case shows deliberate and ongoing dishonesty by a Senior Managing Director of Taylor Woodings and FTI Consulting. Bankwest appointed the person involved and was complicit in the fraud. A senior Bankwest Manage even issued an instruction to “Sink Boots into Customer”.

Current senior managers of FTI Consulting in Australia have been aware of these issues for years yet have failed to act. The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) in 2018 started an Inquiry into just one aspect of this case and they instigated a case appraisal by an independent Barrister Solicitor. Initially FTI Consulting refused to cooperate with the ASBFEO investigation however they changed their mind when publication of their refusal was threatened. In the Case Appraisal, the opinion concluded is that the FTI Director involved broke multiple sections of Australian Corporations Law. In my opinion it is a clear-cut case of dishonesty and an ongoing cover-up. The evidence is all in the form of written communications that can’t be disputed. It will be easy to prosecute, and the allegations are very serious.

As well as the issue investigated by the ASBFEO is the potentially more serious issue covered below of providing deliberately false and misleading information to a 2012 Australian Senate Inquiry. This is Contempt of Parliament and potentially carries a jail term. Current Australian Senior Managing Directors of FTI Consulting are aware of this and are continuing the cover-up which is just as serious.

In June this year was contacted by Heather Klink, the FTI Consulting Deputy General Counsel from America. She as well as other Senior American FTI Officers and Directors are now aware of these issues and I hope they will now investigate and take appropriate action.

I have more detailed information on this case generally with links to supporting documents on websites at: https://www.bankwestinfo.com/sink-boots-into-customer.html

I request that ASIC review this case and that if they find fraudulent conduct (which they will) then a full inquiry be conducted at FTI Consulting’s expense and charges be laid against those responsible (penalties for these sorts of offences include jail) and compensation be paid to those affected. There has been a Royal Commission into the Banking Sector… I am now providing you proof of white-collar embezzlement and fraud. The head of the CBA Matt Comyn is aware of my case as are senior FTI Consulting Directors in Australia and have failed to act.

How I discovered FTI Dishonesty on this matter:

FTI Consulting had been illegally withholding documents despite numerous requests from me to get the documents released. On 3rd December 2015, after years of requests and then under threat of exposure at a Parliamentary Committee Inquiry, FTI Consulting finally released 45 archive boxes of materials.

Within the documents they released was a box of materials covering their Directors appearance at the 2012 Senate Inquiry into the post GFC banking. I had not seen these documents before.

Within these documents are materials that prove that they lied to a Senate Inquiry in 2012. The Receiver, Mark Englebert of FTI Consulting has deliberately lied in order to justify what is in effect embezzlement of at least $339,000. The documents released also revealed they had made a series of false and misleading statements to the 2012 Senate Inquiry regarding their conduct through the receivership. They had requested their evidence be given in camera (or in secret) so I had not been aware of this at the time. If I had been I would have told the Senators what was going on and they could have requested something be done about it. Senior Bankwest managers were involved in meetings with the receivers in the preparation of these documents and they were fully aware of serious misconduct by the receiver at the time but failed to act. This in itself a criminal offence.

Misleading Statements made by Bankwest Receiver Mark Englebert of Taylor Woodings / FTI Consulting regarding my conduct to the Senate Inquiry in 2012.

Letter dated 8 October 2012 (DOC 02)

(Numbers below relate to numbered items in the letter)

26 Mr Butler gave us reason for concern. FALSE 1

26(a) Mr Butler did not comply with statutory requests for information FALSE 2

26(d) Breached law by engaging with employees FALSE 3

31 They did not threaten me with a restraining order FALSE 4

33 Books and records did not show evidence of our employment FALSE 5

33 We did not assert that we were employees until late August FALSE 6

34(a) Our roles were redundant FALSE 7

47(b) I said I would start work in a new business in direct competition FALSE 8

82(b) My submission that another party were interested was false FALSE 9

82(d) They can’t comment on Mr Benaris offer for $14m FALSE 10

89 The absence of an engineer’s report meant costs couldn’t be estimated FALSE 11

96 I said it was a waste of time requesting information FALSE 12

114(c) The previous valuation did not reflect the hotel in its current condition FALSE 13

128(a) I sought to obtain information from Lighthouse Hotel staff FALSE 14

128(b) Staff had concerns over my contact with them FALSE 15

130 Our appointment was welcomed by staff Highly unlikely

133(c) They considered safety and asbestos issues FALSE 16

Under Bankwest receivers’ management our company profits diminished, and our business was destroyed. My case is one of many involving Bankwest.

Profits for September 2011 halved from $73,456 to $33,000. Their fees at this point more than consumed ALL profits.

They charged us a total of $1,334,498 to sell just two Hotels. This cannot be justified and is in effect embezzlement.

I authorize the public use of these documents and I believe it’s very much in the public interest that the conduct of Bankwest appointed receivers be made known to the media, regulators and politicians.

Some of these documents and others showing Bankwests and their receivers conduct are available through a drop box link at:

https://www.dropbox.com/sh/8kh9op94y8lxml4/AAC1MTwQ_fFMX22OOfq9HEGIa?dl=0

On 8th October 2012 Bankwest appointed receiver Mark Englebert of Taylor Woodings (now renamed FTI Consulting) sent a letter DOC 02 to Senator David Bushby, the Chairman of the Senate Economics Reference Committee in response to statements and material I had made to the sector a few months earlier.

Companies I am a director and Shareholder of were placed in receivership by Bankwest on 18 July 2011.

The companies were profitable and solvent and had paid all interest on all loans until early 2011 and could have continued to do so had not a co-director, Mr Benari, The former CEO of Challenger, told Bankwest he would buy one of the properties involved and then defaulted on that agreement.

DOC 150

Misleading statements made by Bankwest Receiver about my conduct:

In a letter from Mark Englebert 8 October 2012

to Senator David Bushby, Senate Economics Reference Committee DOC02

(Numbers below relate to numbered items in the letter)

26 “From the outset of the receiverships, Mr Butler gave us reason for concern regarding the carrying out of our duties and the exercise of our powers in the course of our appointment.”

THIS IS A BASELESS ALLEGATION AND FALSE.

What is even more disturbing is that Mark Englebert estimates that he has charged my companies an estimated $105,000 + $234,000 = $339,000 as a result of “our dealings with Mr Butler” as in his Email to Senator Bushby dated 31 October 2012 DOC 06 p7.

I was at all times cooperative in my dealings with the receivers and it appears I have been charged an extra $339,000 all because I asked questions relating to getting trading results for the hotel and concerns over what they were doing.

Further to this I provide evidence of my efforts to help DOC1F page 2 on

On 22 July I advised Jeremy Nipps of Taylor Woodings by email that DOC 24 item 1:

"1) as requested I or my wife will not be involved in any way with the management or operation or security of the Lighthouse Hotel or the National Hotel unless advised otherwise and your company is now responsible."

I only visited the Hotel about 4 times over the year following their appointment, I live in Perth which is 1 ¾ hours drive from the Hotel in Bunbury. the first time was almost 2 months after they had taken over and was to stay one night to attend a Diocesan Resource Committee meeting. I wrote DOC 25 p2

"This will be the first time I have been at the property since the receivers were appointed and I have not interfered in your management of the property and will not do so."

If you read their response DOC 25 lower P1 you will see what I was dealing with.

I went on to write DOC 25 top P1

"If I require a site inspection I will let you know” and “I ended up staying a second night in Bunbury but ended up staying at the Lord Forrest Hotel as I don’t want to be seen as interfering in the management (which I will not as discussed)."

26.(a) “did not comply with certain statutory requests for information from us, namely Mr Butler did not provide us with an ASIC Report to affairs” despite a number of requests to do so.”

THIS IS FALSE. I provided hard copies to of the documents as required to Taylor Woodings on 25th August 2011 and have retained hard copies as proof if required. DOC 110.1,2,3,4,5 & 6

For preparation of the reports Mark Englebert provided me with only draft unaudited bookkeepers MYOB accounts attached to a letter dated 9 August 2011 DOC 110. The wording of this letter included

"To assist with the completion of the RATA please find enclosed unaudited Balance Sheets dated 18 July 2011" and “… we make no representation as to their accuracy.”

Page 8 of the RATA documents DOC 110.3 P8 required me to sign a certification that

"I certify that the particulars contained in the above report as to affairs are true to the best of my knowledge and belief"

Given that I had only been provided with draft unaudited bookkeepers accounts and given that I was prevented from contacting the bookkeeper or anyone in my company to verify the accounts I attached an annexure to the RATA documents explaining this fact dated 24.8.2011 DOC 110.4

At a meeting with Englebert and his lawyers I asked if I should have signed the unaudited bookkeepers accounts as being a true record and they agreed no. I asked them what I should do if anything else and they said they couldn’t advise me on this.

** 6 October 2011 email S Butler to Mark Englebert DOC110.7

“If any further information is needed or you need help on any matter regarding the receivership please let me know. I am very keen to get the best outcome for the Bank, our family, and Brian Benari.”

I subsequently sent many more emails to Englebert asking if any further information or help was needed. I have listed these in summary on DOC110.88 (1f)

At no time did Englebert contact me regarding the ASIC reports to affairs.

** 3 November 2011 email the receivers lawyers DOC110.3.11.11

I requested: “Provide details of the failed “information providing’ I have not been informed of any outstanding issues.” The Lawyer replied: “The receivers will respond to those matters”

I also raised other serious concerns including Englebert’s false statements and lack of action on other matters. No response was ever received.

** 19 November 2012 email S Butler to Mark Englebert DOC110.19.11.12

“Is any further information required from me to finish the administration and receivership of the companies involved?”

**10 December 2012 email Mark Englebert to Sean Butler DOC110.10.12.12

“I refer to your email 19 November 2012, I provide comments as follows: 1) Save for the provisions of the signed completed reports as to affairs for Butler Constructions, Lighthouse Beach Holdings and National Hotel”

**11 December 2012 email S Butler to Mark Englebert DOC110.11.12.12

“1) Completed reports as to the affairs of the Companies involved were provided to your office by post on the 24th July 2011 (Butler & Lighthouse Beach Holdings) and hand delivered to Jamie Rath (of Taylor Woodings) at the National Hotel in Fremantle on 24th July 2011.”

“3) You took possession of our property at the Lighthouse Hotel on 18th July 2011 and refused to allow us access to company records and accounts subsequently. We were also told not to contact our bookkeeper at the Hotel. You provided us by email on 9th August 2011 DRAFT unaudited MYOB company accounts only and we attempted to complete the reports to the best of our ability based on the limited information provided and without access to our bookkeeper, accountant or company records or professional help.”

“4) Matters including “certain statutory requests for information” (13d) were raised in a letter we received from your lawyers Minter Ellison on your behalf dated 18th August 2011…. That letter contained a number of false allegations about our behaviour that we addressed and many disproved in subsequent correspondence to you.”

**10 January 2013 Letter Minter Ellison to Sean Butler DOC110.10.1.13

Receivers lawyers who we were paying for.

“We refer to your email to Mr Englebert dated 11 December. In relation to the reports as to affairs in respect of the above companies, our clients do not require any further information from you.”

26(d) Breached law by engaging with employees.

Another False allegation.

31. “Mr Butlers submission that we “threatened” him with a restraining order and later retracted some of our “demands” is not an accurate reflection of events as they occurred”

18 August 2011 Letter to Sean Butler from Minter Ellison acting for Englebert:

“17. request an undertaking from me that I not (a) attend or enter my own property (b) engage, contact or solicit employees, agents or contractors of the companies (c) Engage with the media on ant matter relating to the receiverships” DOC31a

“19 If you refuse we reserve the right to … make an application to court for injunctive relief, restraining your client from interfering with our clients conduct” DOC31b

I had been sacked from my own hotel but offered a job at another hotel in the town renovating it… I needed to use contractors to do this… some of the contractors also worked occasionally at the Lighthouse Hotel, eg painters, plumbers and electricians. It’s a small country town. to ask me not to use the same contractors when doing so wasn’t effecting the receivership was very unfair and making it hard for me to gain employment as a registered builder elsewhere.

33. “…. the books and records of Lighthouse Beach Resort and Butler Constructions did not in our view suggest or evidence that Mr Butler or his wife, Mrs Margherita Butler, were employees of either of these entities…”

FALSE

On 8 August Mark Engleberts sent me a letter with Attached Accounts. The Balance Sheet of Butler Constructions show

"S & M Butler- Wages UNDRAWN" DOC 23

The MYOB bookkeepers accounts and Bank Statements they had access to showed regular payments for wages.

Further to this we sent group certificates and other information clearly proving we were employees but they still required more evidence.

33. “Mr Butler and Mrs Butler did not assert that they were employees of Butler Constructions until in or about late August or early September 2011 (see tab 2)”

FALSE

This lie was also repeated in a letter Englebert wrote to the Insolvency practitioners association following my complaint to them DOC140 iem 10

I advised Jeremy Nipps of Taylor Woodings by email on 22 July 2011 DOC 24 item 4 that we were:

"4) I and my wife are employees of Butler Construction and have in the past drawn a wage."

Englebert also lied in person at the Senate hearings in Canberra.

Senate Hansard 10 October 2012 DOC 05 page 3

Englebert answers Senator Williams: "Mr Butler did not raise with us that he was an employee, he was not taking regular drawings from the business and in his discussion with us he did not raise the fact that he was an employee" THIS IS A LIE

34. (a) “…even if Mr & Mrs Butler were employees of Butler Constructions we considered their roles (if any) to be redundant and unnecessary in the circumstances and on the basis that:

I had overseen the successful operation of the hotel and under my supervision profits had risen from $12,000 per annum in 2003 to $796,000 in 2010 – 2011.

Taylor Woodings and their solicitors went on to charge $1,355,954 to do my role and to sell the two Hotels. I have written to Mark Englebert asking “I do not see how these amounts can be justified given that all has been done is to sell two hotels. Any comments you have in this regard would be appreciated.” Email dated 7 December 2015 DOC I have had no reply.

Further to this Mark Englebert by his own admission estimates his fees for managing the Lighthouse Beach resort for just nine months to be $211,000 as in his letter to Senator David Bushby dated 31 October 2012 page 7 DOC If The current general manager of the Lighthouse Beach Resort was undertaking the task of managing the resort with sufficient skill then why was Taylor Woodings charging an extra $211,000 to run it.

My role as former employee of Butler Constructions also involved rebuilding and selling the National Hotel in Fremantle. Taylor Woodings terminated my employment and took over that role. Their staff proved to be totally incompetent in the role of finalising the costs to complete this building the result of which was a complete financial disaster.

In summary Mark Englebert fabricated lies in order to justify sacking me allowing his company then to take over what was a very profitable and successful business and gouge it in fees.

Fair work advised us to pursue.

47 (b) “Mr Butler stated that, in the event that we did not accede to this request, he and Mrs Butler would “start work on a new business and property in direct competition to the Lighthouse Hotel…”

Englebert has selected some text to deceive without putting it in context

I would have said if the business had sold without a deed of restraint, I may do that. Not beforehand, why would I want to diminish the value of my own business. it just wouldn’t make any commercial sense for me to do that. The email below is what I did say:

22 August 2011 Email Sean Butler to Englebert DOC31

“I have not engaged contacted or solicited (or attempted to) employees of the companies and will not do. I have not refused to comply with any requests as far as I am aware. Please advise what this item refers to and I will supply what was requested if I can? I have not acted in a way adverse to the efficient conduct of the receivership. I have helped in any way I can and want the best outcome possible. I have no intention whatsoever in taking business customers or staff away from the Lighthouse business… I will not interfere with the receivership”

82 (b). “Mr Butlers submission that another syndicate who were in the process of putting in an offer for the purchase of the Lighthouse had sold and to ‘go away’ is not an accurate reflection of events…. The syndicate he referred to in his submission did not submit a formal offer…”

Mr Englebert is misrepresenting the facts:

I have undisputable evidence that an interested party in the Lighthouse Hotel was told not to put an offer in. See attached email DOC 125 lower p 3 The selling agent says “The receiver has advised today that as negotiations are very advanced that they will not be treating on any other offers unless the dealing fails” This party were looking at putting an offer of close to $14m in but were told not as shown in the email. Englebert then sold it to Banker Brian Benari, the CEO of Challenger, a co-director of one of the companies involved, for around $9.5m. Benari has just a few months before had agreed to pay for $14m which he defaulted on and then reduced this offer to $13.7m which Bankwest refused to accept. This evidence is indisputable and proves gross negligence and dishonesty by Englebert. Bankwest Manager David Gilbert was aware of all of this at the time but failed to act.

82. (d) “(ii).“the alleged offer from Mr Benari for the sum of $14m was, in our understanding, made prior to our appointment to the companies. We are therefore unable to make any comment in relation to that alleged offer.”

They were provided full details of this offer and the history behind it. Bankwest was fully aware of this, their comment "alleged offer" is misleading. They were given a written legal memo that the offer is enforceable ( DOC 150 ) yet they say they can’t comment. If they were doing their job they should have got advice on this but to say it was an alleged offer and that they can’t comment is untrue.

89 “…we formed the view that in the absence of such a structural engineer’s report would make it difficult for an accurate cost to complete to be prepared…”

Then how come RBB had done one as per item DOC 02 94a “a cost to complete that had been prepared by Ralph Beattie Bosworth Pty Ltd on 21 March 2010 was available for inspection”

96. “On 20 December 2011, Mr Butler attended our office and….said that it was a waste of time and money for us to go through the process of requesting information from him.”

This is clearly intended to make it look like I was being difficult and needs to be explained in

context. It was a waste of time and money for them to get me to do what they were asking

and I fully explained this to Mr Englebert in an email a few days later on 28 December 2011

DOC 121 What I said was:

“The work you requested me to do was I believe a waste of both your (which I get charged for)

and my time. It would not assist EMECO in any meaningful way to revise the cost to complete.

The cost to complete should be assessed on what’s left onsite to do now. I can assist in this by

meeting builders and tradesmen as before if required or even just talking to them on the phone

to explain. Another way would be just to say what percentage of each cost item has been done

(e.g. 70% of plastering) and work it out that way.”

114 (c) “Mr Butlers submission that the National Hotel was valued at $7m prior to our appointment must be considered in the context of that valuation”…. The previous valuation “did not, in Colliers opinion, accurately reflect the value of the hotel in its current condition (being a partially complete building)”

This statement by Englebert is very misleading. The earlier valuation in July 2010 DOC128 (full valuation) and DOC129 just the relevant valuation pages:

Page 34: “The analysis indicates a potential “As if Complete value of $10,470,000 walk-in/walk-out….. After deducting an allowance for the cost to complete of approximately $3,419,000, the value “As is” equates to $7,050,000…”

Proving the previous valuation DID, in the Bank valuers, opinion reflect the valuation of the Hotel in its current, uncompleted state.

128. (a) “Mr Butler had, following our appointment, sought to obtain information (including trading information) from the Lighthouse Beach Resort staff after we had informed he was not entitled to that information generally.”

THIS IS FALSE. I at no time did this. Englebert accused me if this at the time and told both him and Bankwest Managers that this was a false allegation and I requested that he provide proof which he never did. DOC 10

In an email I sent to Mr Englebert 22 August 2011 DOC 31 item b) I stated, "I have not requested any reports on the business from the staff" And I did not do so at any time after they told me I was not to.

I also took these false allegations up with the Insolvency Practitioners Association in 2012 but they refused to look into it and again with ARITA in 2015 and they have again refused to look into it. There are no regulators in cases like this.

It is grossly unfair that a business owner can be kept in the dark by Bankwest Receivers and denied any information on what is happening. Mr Englebert advised me on 1 August 2011 DOC 120 “You will not be, or entitled to, the receipt of information relating to the trade, occupancy levels or otherwise od the Lighthouse (Hotel)…"

128. (b) “we had been informed by staff at the Lighthouse Beach Resort that they had concerns regarding Mr Butlers contact with them.”

I did nothing to hinder the operation of the Hotel or the receivership and had hardly any contact with the staff at any time during the receivership.

On 12 Sept 2011 I advised Mr Englebert by email DOC 25 p2 that I was planning to stay at the Hotel to attend a voluntary committee meeting and that this was the first time I had been to the property in almost 2 months. I stated

"I have not interfered in your management of the property and will not do so ”

On 11 November I advised Bankwest of my concerns over serious false allegations being made by Mr Englebert and requested any details to substantiate his false claims DOC 10. Both Bankwest and Mr Englebert did not provide any evidence whatsoever to justify these claims.

This allegation I believe to be untrue, they have provided no evidence to support it as I have requested and they should now be requested to prove this with the names of the staff involved and what they said so it can be checked.

130. “… our appointment was welcomed by the staff at the Lighthouse Beach Resort. We say this on the basis that we have received positive feedback from the staff regarding our performance…”

This Statements requires proof. Highly unlikely

From the little contact I had with about three of the staff during the time of the receivership (in the vicinity of 3 or 4 discussions over a coffee over a period of about 9 months). This statement seems highly unlikely to be true. Mark Englebert should be asked to provide details to prove this claim, I believe he’s made it up.

133 (c) “we had in relation to the Lighthouse Beach Resort, taken the necessary steps to ensure that health, occupational health and safety, and other relevant legislation and regulation was being complied with, including in relation to dealings with asbestos…”

This is UNTRUE and had it not been for my immediate involvement the Electrician and others may have breathed in asbestos fibres which can ultimately be fatal.

I was told by a subcontractor working for me that an electrician was working on electrical boards at the Lighthouse Hotel. I was aware they contained asbestos and immediately phoned on mobile and told the contractor to stop any work on the asbestos.

I had read that these meter boards probably contained asbestos. Failure to deal with properly include fines up to $150,000 or three years imprisonment. DOC 52

After I had instructed the electrician to stop work rung the receivers also to tell them and was told by Jeremy Nipps at Taylor Woodings that he had it all under control and that I should not have contacted the electrician. I then wrote expressing my concerns regarding Asbestos email dated 20 Oct 2011. DOC51

Documents now returned to us by the receivers prove that they didn’t have this under control:

Taylor Woodings Memorandum 20/10/11 DOC 53 says:

“Asbestos samples all positive (Switchboards)”

So it was only after I raised my concerns with them that they took action to check up on this.

I received a letter from the receivers Lawyers dates 4 November stating that in item 18:

“To the extent that you continue to engage (or purport to engage) contractors of the Lighthouse Beach Resort (including the electrician contacted to perform works on the Lighthouse Beach Resort), our clients repeat the comments contained I our letter dated 18 August, in relation to your lack of authority to, amongst other things, engage, deal with or direct employees, agents, advisors and contractors of the relevant Companies.” In that letter they requested that I not engage contractors of the companies which in this case was a very unfair request given that I had been offered employment at another hotel requiring my subcontractors after they sacked me from my own company.

So they have engaged a lawyer at my expense to tell me not to talk to subcontractors when all I did was raise concerns regarding asbestos which turned out to be justified.

Company Profitability:

Our company was very profitable and at record levels but Bankwest still put in receivers. Under their management profits diminished to a point where it appears their fees exceeded total profits as is indicated below:

On 10 May the Manager of the Lighthouse Hotel advised me by email that “…. It looks like the best April for 5 years! … and looking at the profit compared to last year that we beat that profit by $34,725 and that’s with an increase in Maintenance spend of $8k.” DOC 27

On 15 June I advised Bankwest by email DOC 26

“The adjusted profit (11 months July 10 – May 2011) has increased by $204,235, or 34% on last years…” (which was more than enough to cover all our interest payments going forward).

“…. Profit for April and May is above the best on record for those months…”

Despite this Bankwest appointed receivers to our business one month later on 18 July.

The receivers and their lawyers then went on to charge us over $1.3m just to sell our two hotels… how can any business stand this.

On 21 July 2011 I advised Taylor Woodings by email of our trading results:

“The lighthouse profit was $12,000 (per annum) when we purchased it (in 2003)…..

We have just had the best June quarter on record:

2011 126,992

2010 101,004

2009 51,172

If we can continue the trend and make adjustments as needed the profits should exceed $1.2m in 2011-2012.

This would cover all Lighthouse Bankwest interest business payments and leave a profit for my company to be re invested in the business top grow it further as we have done in the past”

30 September 2011 Taylor Woodings memo DOC 28:

Page 1 shows Butler Constructions cash & equivalent at $427,000 and total; receivables $760,498.

Page 2 shows total payables of $555,756 and a nett surplus of $204,692.

Page 3 shows Trading profits for September at $33,000.

The profit and loss account for the same period September 2010 DOC 29 shows a profit of $73,456.

Receivers were appointed 18 July 2011, within two months of their appointment the profitability of my company under their management had halved.

Their fees (excluding their Legals) for the first 44 days of their appointment to 31 August were $56,258 DOC 30 This equates to about $$1,287 per day or $38,000 a month.

The net result was that the company was destroyed, and all profits were devoured by the receivers.

Their total fees just for this entity including legals (excluding the actual hotel sales) were $614,069.

The Company was closed; by the time they had finished its goodwill had been destroyed.

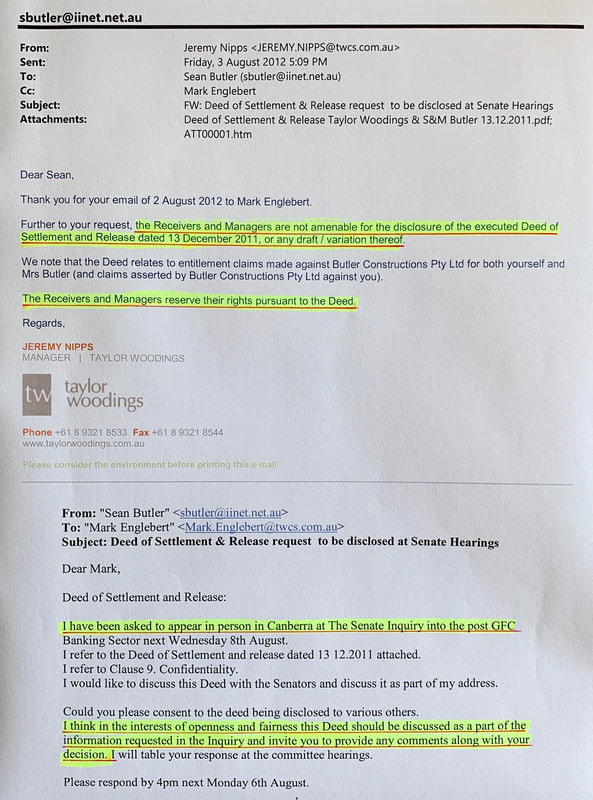

Bankwest receiver Mark Englebert didn’t want us to disclose a Deed that prevented us telling the truth about their actions to a Senate Inquiry in 2012 and then lied to the Inquiry regarding this:

In his opening statement to the Senate Economics Reference Committee on 19-10-2012 DOC 102 Mr Englebert states:

“First, I deny that I or anybody else did anything to try to prevent Mr Butler giving evidence to this committee. The committee would have seen my email of 7 August. In the email I did not in any way suggest Mr Butler did not give evidence before the committee”

This is UNTRUE:

On 2 August 2011 I emailed Englebert DOC 100 p2 asking:

“I have been asked to appear in person in Canberra at The Senate Inquiry into the post GFC Banking Sector next Wednesday 8th August.

I refer to the Deed of Settlement and release dated 13 12.2011 attached.

I refer to Clause 9. Confidentiality.

I would like to discuss this Deed with the Senators and discuss it as part of my address.

Could you please consent to the deed being disclosed to various others.

I think in the interests of openness and fairness this Deed should be discussed as a part of the information requested in the Inquiry and invite you to provide any comments along with your decision. I will table your response at the committee hearings.”

They responded on 3 August DOC 100 p1:

Clearly showing they are trying to prevent me giving evidence to the Senate Inquiry:

By Sean Butler, Perth, Western Australia [email protected] 0419 964 487

FTI Consulting Australian Directors fail to report contempt of Parliament.

Senior Managing Director lied to an Australian Senate Inquiry.

Senate Inquiry into the post GFC banking sector 2012

Bankwest managers involved and instructed the Receiver to "Sink Boots into Customer."

See the lying Corporate thug Bankwest / FTI Consulting manager squirm at the Senate Hearings Click LINK

In this video Mark Englebert requested his evidence be given "in camera" or in secret.. We found out several years later that he provided deliberately false and misleading evidence to the Senate Committee to prevent further investigation. This is contempt of Parliament and if prosecuted can carry a jail term.

As a result of widespread misconduct uncovered during the recent Australian Banking Royal Commission the Australian Government has increased funding to ASIC, appointed a new chairman of ASIC and broadened its powers of inquiry. ASIC now has a mandate to take legal action, to prosecute and to fine financial organisations found to have acted dishonestly. The public and political sentiment in Australia towards financial organisations has changed following damming evidence given to the Royal Commission. The public and politicians now want to see action on enforcement and prosecution to deter this sort of conduct. The case below could also result in Jail terms for some involved.

This case shows deliberate and ongoing dishonesty by a Senior Managing Director of Taylor Woodings and FTI Consulting. Bankwest appointed the person involved and was complicit in the fraud. A senior Bankwest Manage even issued an instruction to “Sink Boots into Customer”.

Current senior managers of FTI Consulting in Australia have been aware of these issues for years yet have failed to act. The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) in 2018 started an Inquiry into just one aspect of this case and they instigated a case appraisal by an independent Barrister Solicitor. Initially FTI Consulting refused to cooperate with the ASBFEO investigation however they changed their mind when publication of their refusal was threatened. In the Case Appraisal, the opinion concluded is that the FTI Director involved broke multiple sections of Australian Corporations Law. In my opinion it is a clear-cut case of dishonesty and an ongoing cover-up. The evidence is all in the form of written communications that can’t be disputed. It will be easy to prosecute, and the allegations are very serious.

As well as the issue investigated by the ASBFEO is the potentially more serious issue covered below of providing deliberately false and misleading information to a 2012 Australian Senate Inquiry. This is Contempt of Parliament and potentially carries a jail term. Current Australian Senior Managing Directors of FTI Consulting are aware of this and are continuing the cover-up which is just as serious.

In June this year was contacted by Heather Klink, the FTI Consulting Deputy General Counsel from America. She as well as other Senior American FTI Officers and Directors are now aware of these issues and I hope they will now investigate and take appropriate action.

I have more detailed information on this case generally with links to supporting documents on websites at: https://www.bankwestinfo.com/sink-boots-into-customer.html

I request that ASIC review this case and that if they find fraudulent conduct (which they will) then a full inquiry be conducted at FTI Consulting’s expense and charges be laid against those responsible (penalties for these sorts of offences include jail) and compensation be paid to those affected. There has been a Royal Commission into the Banking Sector… I am now providing you proof of white-collar embezzlement and fraud. The head of the CBA Matt Comyn is aware of my case as are senior FTI Consulting Directors in Australia and have failed to act.

How I discovered FTI Dishonesty on this matter:

FTI Consulting had been illegally withholding documents despite numerous requests from me to get the documents released. On 3rd December 2015, after years of requests and then under threat of exposure at a Parliamentary Committee Inquiry, FTI Consulting finally released 45 archive boxes of materials.

Within the documents they released was a box of materials covering their Directors appearance at the 2012 Senate Inquiry into the post GFC banking. I had not seen these documents before.

Within these documents are materials that prove that they lied to a Senate Inquiry in 2012. The Receiver, Mark Englebert of FTI Consulting has deliberately lied in order to justify what is in effect embezzlement of at least $339,000. The documents released also revealed they had made a series of false and misleading statements to the 2012 Senate Inquiry regarding their conduct through the receivership. They had requested their evidence be given in camera (or in secret) so I had not been aware of this at the time. If I had been I would have told the Senators what was going on and they could have requested something be done about it. Senior Bankwest managers were involved in meetings with the receivers in the preparation of these documents and they were fully aware of serious misconduct by the receiver at the time but failed to act. This in itself a criminal offence.

Misleading Statements made by Bankwest Receiver Mark Englebert of Taylor Woodings / FTI Consulting regarding my conduct to the Senate Inquiry in 2012.

Letter dated 8 October 2012 (DOC 02)

(Numbers below relate to numbered items in the letter)

26 Mr Butler gave us reason for concern. FALSE 1

26(a) Mr Butler did not comply with statutory requests for information FALSE 2

26(d) Breached law by engaging with employees FALSE 3

31 They did not threaten me with a restraining order FALSE 4

33 Books and records did not show evidence of our employment FALSE 5

33 We did not assert that we were employees until late August FALSE 6

34(a) Our roles were redundant FALSE 7

47(b) I said I would start work in a new business in direct competition FALSE 8

82(b) My submission that another party were interested was false FALSE 9

82(d) They can’t comment on Mr Benaris offer for $14m FALSE 10

89 The absence of an engineer’s report meant costs couldn’t be estimated FALSE 11

96 I said it was a waste of time requesting information FALSE 12

114(c) The previous valuation did not reflect the hotel in its current condition FALSE 13

128(a) I sought to obtain information from Lighthouse Hotel staff FALSE 14

128(b) Staff had concerns over my contact with them FALSE 15

130 Our appointment was welcomed by staff Highly unlikely

133(c) They considered safety and asbestos issues FALSE 16

Under Bankwest receivers’ management our company profits diminished, and our business was destroyed. My case is one of many involving Bankwest.

Profits for September 2011 halved from $73,456 to $33,000. Their fees at this point more than consumed ALL profits.

They charged us a total of $1,334,498 to sell just two Hotels. This cannot be justified and is in effect embezzlement.

I authorize the public use of these documents and I believe it’s very much in the public interest that the conduct of Bankwest appointed receivers be made known to the media, regulators and politicians.

Some of these documents and others showing Bankwests and their receivers conduct are available through a drop box link at:

https://www.dropbox.com/sh/8kh9op94y8lxml4/AAC1MTwQ_fFMX22OOfq9HEGIa?dl=0

On 8th October 2012 Bankwest appointed receiver Mark Englebert of Taylor Woodings (now renamed FTI Consulting) sent a letter DOC 02 to Senator David Bushby, the Chairman of the Senate Economics Reference Committee in response to statements and material I had made to the sector a few months earlier.

Companies I am a director and Shareholder of were placed in receivership by Bankwest on 18 July 2011.

The companies were profitable and solvent and had paid all interest on all loans until early 2011 and could have continued to do so had not a co-director, Mr Benari, The former CEO of Challenger, told Bankwest he would buy one of the properties involved and then defaulted on that agreement.

DOC 150

Misleading statements made by Bankwest Receiver about my conduct:

In a letter from Mark Englebert 8 October 2012

to Senator David Bushby, Senate Economics Reference Committee DOC02

(Numbers below relate to numbered items in the letter)

26 “From the outset of the receiverships, Mr Butler gave us reason for concern regarding the carrying out of our duties and the exercise of our powers in the course of our appointment.”

THIS IS A BASELESS ALLEGATION AND FALSE.

What is even more disturbing is that Mark Englebert estimates that he has charged my companies an estimated $105,000 + $234,000 = $339,000 as a result of “our dealings with Mr Butler” as in his Email to Senator Bushby dated 31 October 2012 DOC 06 p7.

I was at all times cooperative in my dealings with the receivers and it appears I have been charged an extra $339,000 all because I asked questions relating to getting trading results for the hotel and concerns over what they were doing.

Further to this I provide evidence of my efforts to help DOC1F page 2 on

On 22 July I advised Jeremy Nipps of Taylor Woodings by email that DOC 24 item 1:

"1) as requested I or my wife will not be involved in any way with the management or operation or security of the Lighthouse Hotel or the National Hotel unless advised otherwise and your company is now responsible."

I only visited the Hotel about 4 times over the year following their appointment, I live in Perth which is 1 ¾ hours drive from the Hotel in Bunbury. the first time was almost 2 months after they had taken over and was to stay one night to attend a Diocesan Resource Committee meeting. I wrote DOC 25 p2

"This will be the first time I have been at the property since the receivers were appointed and I have not interfered in your management of the property and will not do so."

If you read their response DOC 25 lower P1 you will see what I was dealing with.

I went on to write DOC 25 top P1

"If I require a site inspection I will let you know” and “I ended up staying a second night in Bunbury but ended up staying at the Lord Forrest Hotel as I don’t want to be seen as interfering in the management (which I will not as discussed)."

26.(a) “did not comply with certain statutory requests for information from us, namely Mr Butler did not provide us with an ASIC Report to affairs” despite a number of requests to do so.”

THIS IS FALSE. I provided hard copies to of the documents as required to Taylor Woodings on 25th August 2011 and have retained hard copies as proof if required. DOC 110.1,2,3,4,5 & 6

For preparation of the reports Mark Englebert provided me with only draft unaudited bookkeepers MYOB accounts attached to a letter dated 9 August 2011 DOC 110. The wording of this letter included

"To assist with the completion of the RATA please find enclosed unaudited Balance Sheets dated 18 July 2011" and “… we make no representation as to their accuracy.”

Page 8 of the RATA documents DOC 110.3 P8 required me to sign a certification that

"I certify that the particulars contained in the above report as to affairs are true to the best of my knowledge and belief"

Given that I had only been provided with draft unaudited bookkeepers accounts and given that I was prevented from contacting the bookkeeper or anyone in my company to verify the accounts I attached an annexure to the RATA documents explaining this fact dated 24.8.2011 DOC 110.4

At a meeting with Englebert and his lawyers I asked if I should have signed the unaudited bookkeepers accounts as being a true record and they agreed no. I asked them what I should do if anything else and they said they couldn’t advise me on this.

** 6 October 2011 email S Butler to Mark Englebert DOC110.7

“If any further information is needed or you need help on any matter regarding the receivership please let me know. I am very keen to get the best outcome for the Bank, our family, and Brian Benari.”

I subsequently sent many more emails to Englebert asking if any further information or help was needed. I have listed these in summary on DOC110.88 (1f)

At no time did Englebert contact me regarding the ASIC reports to affairs.

** 3 November 2011 email the receivers lawyers DOC110.3.11.11

I requested: “Provide details of the failed “information providing’ I have not been informed of any outstanding issues.” The Lawyer replied: “The receivers will respond to those matters”

I also raised other serious concerns including Englebert’s false statements and lack of action on other matters. No response was ever received.

** 19 November 2012 email S Butler to Mark Englebert DOC110.19.11.12

“Is any further information required from me to finish the administration and receivership of the companies involved?”

**10 December 2012 email Mark Englebert to Sean Butler DOC110.10.12.12

“I refer to your email 19 November 2012, I provide comments as follows: 1) Save for the provisions of the signed completed reports as to affairs for Butler Constructions, Lighthouse Beach Holdings and National Hotel”

**11 December 2012 email S Butler to Mark Englebert DOC110.11.12.12

“1) Completed reports as to the affairs of the Companies involved were provided to your office by post on the 24th July 2011 (Butler & Lighthouse Beach Holdings) and hand delivered to Jamie Rath (of Taylor Woodings) at the National Hotel in Fremantle on 24th July 2011.”

“3) You took possession of our property at the Lighthouse Hotel on 18th July 2011 and refused to allow us access to company records and accounts subsequently. We were also told not to contact our bookkeeper at the Hotel. You provided us by email on 9th August 2011 DRAFT unaudited MYOB company accounts only and we attempted to complete the reports to the best of our ability based on the limited information provided and without access to our bookkeeper, accountant or company records or professional help.”

“4) Matters including “certain statutory requests for information” (13d) were raised in a letter we received from your lawyers Minter Ellison on your behalf dated 18th August 2011…. That letter contained a number of false allegations about our behaviour that we addressed and many disproved in subsequent correspondence to you.”

**10 January 2013 Letter Minter Ellison to Sean Butler DOC110.10.1.13

Receivers lawyers who we were paying for.

“We refer to your email to Mr Englebert dated 11 December. In relation to the reports as to affairs in respect of the above companies, our clients do not require any further information from you.”

26(d) Breached law by engaging with employees.

Another False allegation.

- August 2011 Email Sean Butler to Mark Englebert DOC31

31. “Mr Butlers submission that we “threatened” him with a restraining order and later retracted some of our “demands” is not an accurate reflection of events as they occurred”

18 August 2011 Letter to Sean Butler from Minter Ellison acting for Englebert:

“17. request an undertaking from me that I not (a) attend or enter my own property (b) engage, contact or solicit employees, agents or contractors of the companies (c) Engage with the media on ant matter relating to the receiverships” DOC31a

“19 If you refuse we reserve the right to … make an application to court for injunctive relief, restraining your client from interfering with our clients conduct” DOC31b

I had been sacked from my own hotel but offered a job at another hotel in the town renovating it… I needed to use contractors to do this… some of the contractors also worked occasionally at the Lighthouse Hotel, eg painters, plumbers and electricians. It’s a small country town. to ask me not to use the same contractors when doing so wasn’t effecting the receivership was very unfair and making it hard for me to gain employment as a registered builder elsewhere.

33. “…. the books and records of Lighthouse Beach Resort and Butler Constructions did not in our view suggest or evidence that Mr Butler or his wife, Mrs Margherita Butler, were employees of either of these entities…”

FALSE

On 8 August Mark Engleberts sent me a letter with Attached Accounts. The Balance Sheet of Butler Constructions show

"S & M Butler- Wages UNDRAWN" DOC 23

The MYOB bookkeepers accounts and Bank Statements they had access to showed regular payments for wages.

Further to this we sent group certificates and other information clearly proving we were employees but they still required more evidence.

33. “Mr Butler and Mrs Butler did not assert that they were employees of Butler Constructions until in or about late August or early September 2011 (see tab 2)”

FALSE

This lie was also repeated in a letter Englebert wrote to the Insolvency practitioners association following my complaint to them DOC140 iem 10

I advised Jeremy Nipps of Taylor Woodings by email on 22 July 2011 DOC 24 item 4 that we were:

"4) I and my wife are employees of Butler Construction and have in the past drawn a wage."

Englebert also lied in person at the Senate hearings in Canberra.

Senate Hansard 10 October 2012 DOC 05 page 3

Englebert answers Senator Williams: "Mr Butler did not raise with us that he was an employee, he was not taking regular drawings from the business and in his discussion with us he did not raise the fact that he was an employee" THIS IS A LIE

34. (a) “…even if Mr & Mrs Butler were employees of Butler Constructions we considered their roles (if any) to be redundant and unnecessary in the circumstances and on the basis that:

- Butler Constructions was in receivership: and

- The current general manager of the Lighthouse Beach Resort was undertaking the task of managing the resort with sufficient skill.”

I had overseen the successful operation of the hotel and under my supervision profits had risen from $12,000 per annum in 2003 to $796,000 in 2010 – 2011.

Taylor Woodings and their solicitors went on to charge $1,355,954 to do my role and to sell the two Hotels. I have written to Mark Englebert asking “I do not see how these amounts can be justified given that all has been done is to sell two hotels. Any comments you have in this regard would be appreciated.” Email dated 7 December 2015 DOC I have had no reply.

Further to this Mark Englebert by his own admission estimates his fees for managing the Lighthouse Beach resort for just nine months to be $211,000 as in his letter to Senator David Bushby dated 31 October 2012 page 7 DOC If The current general manager of the Lighthouse Beach Resort was undertaking the task of managing the resort with sufficient skill then why was Taylor Woodings charging an extra $211,000 to run it.

My role as former employee of Butler Constructions also involved rebuilding and selling the National Hotel in Fremantle. Taylor Woodings terminated my employment and took over that role. Their staff proved to be totally incompetent in the role of finalising the costs to complete this building the result of which was a complete financial disaster.

In summary Mark Englebert fabricated lies in order to justify sacking me allowing his company then to take over what was a very profitable and successful business and gouge it in fees.

Fair work advised us to pursue.

47 (b) “Mr Butler stated that, in the event that we did not accede to this request, he and Mrs Butler would “start work on a new business and property in direct competition to the Lighthouse Hotel…”

Englebert has selected some text to deceive without putting it in context

I would have said if the business had sold without a deed of restraint, I may do that. Not beforehand, why would I want to diminish the value of my own business. it just wouldn’t make any commercial sense for me to do that. The email below is what I did say:

22 August 2011 Email Sean Butler to Englebert DOC31

“I have not engaged contacted or solicited (or attempted to) employees of the companies and will not do. I have not refused to comply with any requests as far as I am aware. Please advise what this item refers to and I will supply what was requested if I can? I have not acted in a way adverse to the efficient conduct of the receivership. I have helped in any way I can and want the best outcome possible. I have no intention whatsoever in taking business customers or staff away from the Lighthouse business… I will not interfere with the receivership”

82 (b). “Mr Butlers submission that another syndicate who were in the process of putting in an offer for the purchase of the Lighthouse had sold and to ‘go away’ is not an accurate reflection of events…. The syndicate he referred to in his submission did not submit a formal offer…”

Mr Englebert is misrepresenting the facts:

I have undisputable evidence that an interested party in the Lighthouse Hotel was told not to put an offer in. See attached email DOC 125 lower p 3 The selling agent says “The receiver has advised today that as negotiations are very advanced that they will not be treating on any other offers unless the dealing fails” This party were looking at putting an offer of close to $14m in but were told not as shown in the email. Englebert then sold it to Banker Brian Benari, the CEO of Challenger, a co-director of one of the companies involved, for around $9.5m. Benari has just a few months before had agreed to pay for $14m which he defaulted on and then reduced this offer to $13.7m which Bankwest refused to accept. This evidence is indisputable and proves gross negligence and dishonesty by Englebert. Bankwest Manager David Gilbert was aware of all of this at the time but failed to act.

82. (d) “(ii).“the alleged offer from Mr Benari for the sum of $14m was, in our understanding, made prior to our appointment to the companies. We are therefore unable to make any comment in relation to that alleged offer.”

They were provided full details of this offer and the history behind it. Bankwest was fully aware of this, their comment "alleged offer" is misleading. They were given a written legal memo that the offer is enforceable ( DOC 150 ) yet they say they can’t comment. If they were doing their job they should have got advice on this but to say it was an alleged offer and that they can’t comment is untrue.

89 “…we formed the view that in the absence of such a structural engineer’s report would make it difficult for an accurate cost to complete to be prepared…”

Then how come RBB had done one as per item DOC 02 94a “a cost to complete that had been prepared by Ralph Beattie Bosworth Pty Ltd on 21 March 2010 was available for inspection”

96. “On 20 December 2011, Mr Butler attended our office and….said that it was a waste of time and money for us to go through the process of requesting information from him.”

This is clearly intended to make it look like I was being difficult and needs to be explained in

context. It was a waste of time and money for them to get me to do what they were asking

and I fully explained this to Mr Englebert in an email a few days later on 28 December 2011

DOC 121 What I said was:

“The work you requested me to do was I believe a waste of both your (which I get charged for)

and my time. It would not assist EMECO in any meaningful way to revise the cost to complete.

The cost to complete should be assessed on what’s left onsite to do now. I can assist in this by

meeting builders and tradesmen as before if required or even just talking to them on the phone

to explain. Another way would be just to say what percentage of each cost item has been done

(e.g. 70% of plastering) and work it out that way.”

114 (c) “Mr Butlers submission that the National Hotel was valued at $7m prior to our appointment must be considered in the context of that valuation”…. The previous valuation “did not, in Colliers opinion, accurately reflect the value of the hotel in its current condition (being a partially complete building)”

This statement by Englebert is very misleading. The earlier valuation in July 2010 DOC128 (full valuation) and DOC129 just the relevant valuation pages:

Page 34: “The analysis indicates a potential “As if Complete value of $10,470,000 walk-in/walk-out….. After deducting an allowance for the cost to complete of approximately $3,419,000, the value “As is” equates to $7,050,000…”

Proving the previous valuation DID, in the Bank valuers, opinion reflect the valuation of the Hotel in its current, uncompleted state.

128. (a) “Mr Butler had, following our appointment, sought to obtain information (including trading information) from the Lighthouse Beach Resort staff after we had informed he was not entitled to that information generally.”

THIS IS FALSE. I at no time did this. Englebert accused me if this at the time and told both him and Bankwest Managers that this was a false allegation and I requested that he provide proof which he never did. DOC 10

In an email I sent to Mr Englebert 22 August 2011 DOC 31 item b) I stated, "I have not requested any reports on the business from the staff" And I did not do so at any time after they told me I was not to.

I also took these false allegations up with the Insolvency Practitioners Association in 2012 but they refused to look into it and again with ARITA in 2015 and they have again refused to look into it. There are no regulators in cases like this.

It is grossly unfair that a business owner can be kept in the dark by Bankwest Receivers and denied any information on what is happening. Mr Englebert advised me on 1 August 2011 DOC 120 “You will not be, or entitled to, the receipt of information relating to the trade, occupancy levels or otherwise od the Lighthouse (Hotel)…"

128. (b) “we had been informed by staff at the Lighthouse Beach Resort that they had concerns regarding Mr Butlers contact with them.”

I did nothing to hinder the operation of the Hotel or the receivership and had hardly any contact with the staff at any time during the receivership.

On 12 Sept 2011 I advised Mr Englebert by email DOC 25 p2 that I was planning to stay at the Hotel to attend a voluntary committee meeting and that this was the first time I had been to the property in almost 2 months. I stated

"I have not interfered in your management of the property and will not do so ”

On 11 November I advised Bankwest of my concerns over serious false allegations being made by Mr Englebert and requested any details to substantiate his false claims DOC 10. Both Bankwest and Mr Englebert did not provide any evidence whatsoever to justify these claims.

This allegation I believe to be untrue, they have provided no evidence to support it as I have requested and they should now be requested to prove this with the names of the staff involved and what they said so it can be checked.

130. “… our appointment was welcomed by the staff at the Lighthouse Beach Resort. We say this on the basis that we have received positive feedback from the staff regarding our performance…”

This Statements requires proof. Highly unlikely

From the little contact I had with about three of the staff during the time of the receivership (in the vicinity of 3 or 4 discussions over a coffee over a period of about 9 months). This statement seems highly unlikely to be true. Mark Englebert should be asked to provide details to prove this claim, I believe he’s made it up.

133 (c) “we had in relation to the Lighthouse Beach Resort, taken the necessary steps to ensure that health, occupational health and safety, and other relevant legislation and regulation was being complied with, including in relation to dealings with asbestos…”

This is UNTRUE and had it not been for my immediate involvement the Electrician and others may have breathed in asbestos fibres which can ultimately be fatal.

I was told by a subcontractor working for me that an electrician was working on electrical boards at the Lighthouse Hotel. I was aware they contained asbestos and immediately phoned on mobile and told the contractor to stop any work on the asbestos.

I had read that these meter boards probably contained asbestos. Failure to deal with properly include fines up to $150,000 or three years imprisonment. DOC 52

After I had instructed the electrician to stop work rung the receivers also to tell them and was told by Jeremy Nipps at Taylor Woodings that he had it all under control and that I should not have contacted the electrician. I then wrote expressing my concerns regarding Asbestos email dated 20 Oct 2011. DOC51

Documents now returned to us by the receivers prove that they didn’t have this under control:

Taylor Woodings Memorandum 20/10/11 DOC 53 says:

- “99% sure materials are hardiflex.”

- “No samples taken from electrical boards.”

- “Could contain asbestos. Would need to test.”

“Asbestos samples all positive (Switchboards)”

So it was only after I raised my concerns with them that they took action to check up on this.

I received a letter from the receivers Lawyers dates 4 November stating that in item 18:

“To the extent that you continue to engage (or purport to engage) contractors of the Lighthouse Beach Resort (including the electrician contacted to perform works on the Lighthouse Beach Resort), our clients repeat the comments contained I our letter dated 18 August, in relation to your lack of authority to, amongst other things, engage, deal with or direct employees, agents, advisors and contractors of the relevant Companies.” In that letter they requested that I not engage contractors of the companies which in this case was a very unfair request given that I had been offered employment at another hotel requiring my subcontractors after they sacked me from my own company.

So they have engaged a lawyer at my expense to tell me not to talk to subcontractors when all I did was raise concerns regarding asbestos which turned out to be justified.

Company Profitability:

Our company was very profitable and at record levels but Bankwest still put in receivers. Under their management profits diminished to a point where it appears their fees exceeded total profits as is indicated below:

On 10 May the Manager of the Lighthouse Hotel advised me by email that “…. It looks like the best April for 5 years! … and looking at the profit compared to last year that we beat that profit by $34,725 and that’s with an increase in Maintenance spend of $8k.” DOC 27

On 15 June I advised Bankwest by email DOC 26

“The adjusted profit (11 months July 10 – May 2011) has increased by $204,235, or 34% on last years…” (which was more than enough to cover all our interest payments going forward).

“…. Profit for April and May is above the best on record for those months…”

Despite this Bankwest appointed receivers to our business one month later on 18 July.

The receivers and their lawyers then went on to charge us over $1.3m just to sell our two hotels… how can any business stand this.

On 21 July 2011 I advised Taylor Woodings by email of our trading results:

“The lighthouse profit was $12,000 (per annum) when we purchased it (in 2003)…..

We have just had the best June quarter on record:

2011 126,992

2010 101,004

2009 51,172

If we can continue the trend and make adjustments as needed the profits should exceed $1.2m in 2011-2012.

This would cover all Lighthouse Bankwest interest business payments and leave a profit for my company to be re invested in the business top grow it further as we have done in the past”

30 September 2011 Taylor Woodings memo DOC 28:

Page 1 shows Butler Constructions cash & equivalent at $427,000 and total; receivables $760,498.

Page 2 shows total payables of $555,756 and a nett surplus of $204,692.

Page 3 shows Trading profits for September at $33,000.

The profit and loss account for the same period September 2010 DOC 29 shows a profit of $73,456.

Receivers were appointed 18 July 2011, within two months of their appointment the profitability of my company under their management had halved.

Their fees (excluding their Legals) for the first 44 days of their appointment to 31 August were $56,258 DOC 30 This equates to about $$1,287 per day or $38,000 a month.

The net result was that the company was destroyed, and all profits were devoured by the receivers.

Their total fees just for this entity including legals (excluding the actual hotel sales) were $614,069.

The Company was closed; by the time they had finished its goodwill had been destroyed.

Bankwest receiver Mark Englebert didn’t want us to disclose a Deed that prevented us telling the truth about their actions to a Senate Inquiry in 2012 and then lied to the Inquiry regarding this:

In his opening statement to the Senate Economics Reference Committee on 19-10-2012 DOC 102 Mr Englebert states:

“First, I deny that I or anybody else did anything to try to prevent Mr Butler giving evidence to this committee. The committee would have seen my email of 7 August. In the email I did not in any way suggest Mr Butler did not give evidence before the committee”

This is UNTRUE:

On 2 August 2011 I emailed Englebert DOC 100 p2 asking:

“I have been asked to appear in person in Canberra at The Senate Inquiry into the post GFC Banking Sector next Wednesday 8th August.

I refer to the Deed of Settlement and release dated 13 12.2011 attached.

I refer to Clause 9. Confidentiality.

I would like to discuss this Deed with the Senators and discuss it as part of my address.

Could you please consent to the deed being disclosed to various others.

I think in the interests of openness and fairness this Deed should be discussed as a part of the information requested in the Inquiry and invite you to provide any comments along with your decision. I will table your response at the committee hearings.”

They responded on 3 August DOC 100 p1:

Clearly showing they are trying to prevent me giving evidence to the Senate Inquiry:

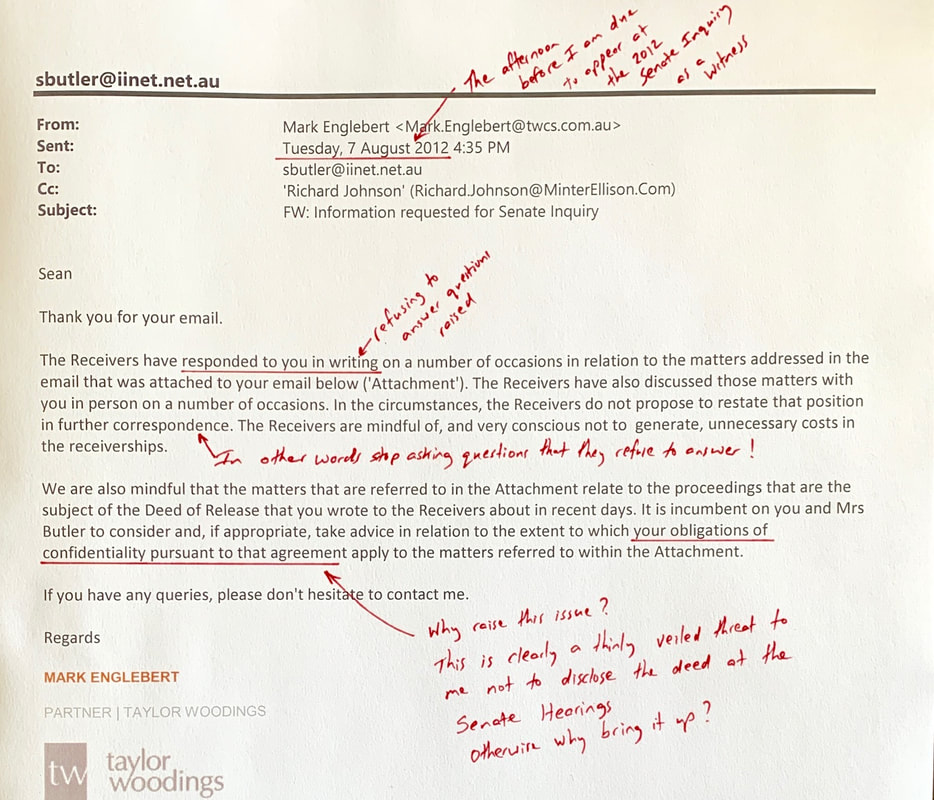

On the same day I responded to Mr Englebert DOC 100 p1 saying:

“In the interests of openness and transparency I request again that you agree to disclosure of the deed.

I have nothing to hide in relation to the claims and had hoped you wouldn’t either.

I will table your response at the hearings.”

Mr Englebert responded the day before I was to attend to give my evidence at the hearings DOC 101:

“In the interests of openness and transparency I request again that you agree to disclosure of the deed.

I have nothing to hide in relation to the claims and had hoped you wouldn’t either.

I will table your response at the hearings.”

Mr Englebert responded the day before I was to attend to give my evidence at the hearings DOC 101:

Taken in context I believe the above clearly shows that Mr Englebert did not want the Deed disclosed to the Senate Inquiry and he lied to the inquiry about this.

The reason I wanted the deed exposed is that it contained confidentiality clauses that attempted preventing us from disclosing his dishonest actions to others including a series of false allegations about me DOC 101 p3 in order to justify my sacking from my own profitable company. This allowed Englebert to go on to charge over $500,000 in excess fees and to destroy the business. Bankwest are fully aware of this.

This is White Collar crime. Mr Englebert should be jailed.

Bankwest Senior Managers are aware of issues raised above:

In an email sent to David Gilbert and Les Nathan at Bankwest 9 November 2011 DOC 70

I wrote: “The things the receivers have indicated need to be done, some of which I had in hand and were doing, have been stopped and not re commenced. Why?

I have been sacked from my own profitable solvent company on the grounds of genuine redundancy which is simply not true. False allegations have been made about me. Why?”

David Gilbert Bankwest replied:

“You have requested a meeting with the Bank, and this can be facilitated. I intend to include the Chief Manager of Credit and Asset Management to also be present.

As the issues you are raising pertain largely to the Receivership issues, I also intend to invite the Receiver and Managers together with our Legal representatives to this proposed meeting.”

In an email I sent to David Gilbert Bankwest 9 Nov 2011 DOC 123 I raised concerns that the receivers had done nothing on certain items required to sell the property.

On 11 Nov 2011 DOC 10 I advised Bankwest Manager David Gilbert “There have been a number of serious false allegations made about me by Mark Englebert. These will be on the agenda. These allegations need to be cleared up….” I then requested further details and proof of these allegations. No details or proof were ever provided. These allegations are ALL FALSE.

I have raised my concerns regarding dishonest conduct by the receiver with Senior Bankwest Manager David Gilbert, Chris Butler and Les Nathan and others on numerous occasions.

In the documents the receiver returned to me in December 2015 there is further evidence Bankwest knew what was going on:

DOC 130 10.9.2012 Three Bankwest senior managers notes discussing Senate Inquiry:

“Suppress issue by not “feeding the media””

“3rd Party “umpire”? might have merit”

Bankwest Manager discussed using a 3rd party umpire… I had requested independent review and arbitration but they ignored my requests. I believe this is because if they had done so it would expose criminal conduct by some involved.

DOC 131 10.9.2012 Bankwest Senior Managers David Nolan, Les Nathan & David Gilbert:

“sink boots into customer”

“DN has info on Senators” (DN = David Nolan, Bankwest Manager)

This says it all. They produced a litany of lies to a Senate Inquiry and tried to keep it secret.

DOC 132 5.10.2012 Receivers notes:

“In camera. Confidential outcome” and “steer away from numbers”

They wanted it kept secret. There was no need for this if they have nothing to hide.

Bankwest Senior managers including David Nolan were fully aware that a document containing false evidence was being prepared and given to the 2012 Senate inquiry. As evidence are invoices from the receivers Lawyers including notations as below:

Notations in invoice from receivers’ lawyers:

DOC 133 1.10.2012 “Preparing documents… and writing to … David Nolan..”

“Considering and responding to email from David Nolan…”

DOC 134 5.10.2011 “Meeting with Counsel, David Nolan of Bankwest… regarding Senate Inquiry”

“Preparing additional brief documents (namely submissions to Senate by Bankwest, CBA etc)”

“Engaged on considering and responding to email from David Nolan”

DOC 135 10.10.2012 “Attending Senate Hearing”

“Preparing summary for David Nolan”

“Email to David Nolan on Senate Hearing”

The cost of the receivers’ preparation and attendance at the 2012 Senate Hearings was:

DOC 136 $ 12,052

DOC 137 $160,233

I have asked them if my company was charged for that (as they have charged us a total of over $1.35m) but to date they have not responded to my request.

On 13 May 2014 I sent a letter DOC 124 with attachments by Registered post personally to Ian Narev the CEO of CBA, Robert De Luca the CEO of Bankwest and to Senior Bankwest Managers David Gilbert, Charles Perry, Ross Dearing and Chris Butler and have receipts for this DOC 125.

In which I again advise of my concerns saying: “I attach and refer to two emails I sent to Mr Charles Perry, Manager Group Credit Structuring, Bankwest Sydney on 7 May 2014 noting and describing unconscionable and dishonest conduct involving Bankwest, Bankwest appointed receiver manager Mark Englebert, and Brian Benari. Some of this conduct is criminal by way of the existence of intent and it is an offence under the Crimes Act for anyone to intentionally conceal such an offence.”

On the 7th & 9th December 2015 sent further emails to Senior Bankwest managers with further evidence of dishonest conduct by Mr Englebert:

This is a draft document and still a work in progress but you need to be aware of just how corrupt some within CBA / Bankwest and the receivership industry are so that action can be taken.

The Banking Royal Commission has shown many cases of white collar crime in the finance sector. Here is proof that Bankwest will lie to try to discredit witnesses.

If the government is genuine in wanting to stamp out corruption in Australia, they also need to look at what is happening in the Finance sector.

I request that an independent arbitrator be called to look at cases exposed in this inquiry. If extensive dishonest conduct is uncovered a Royal Commission should follow. (Which then happened in 2018)

I can provide further evidence if required and can fly over to Canberra if necessary, to discuss further.

Regards,

Sean Butler

Perth

0419 964 487

[email protected]

Other issues to raise

The reason I wanted the deed exposed is that it contained confidentiality clauses that attempted preventing us from disclosing his dishonest actions to others including a series of false allegations about me DOC 101 p3 in order to justify my sacking from my own profitable company. This allowed Englebert to go on to charge over $500,000 in excess fees and to destroy the business. Bankwest are fully aware of this.

This is White Collar crime. Mr Englebert should be jailed.

Bankwest Senior Managers are aware of issues raised above:

In an email sent to David Gilbert and Les Nathan at Bankwest 9 November 2011 DOC 70

I wrote: “The things the receivers have indicated need to be done, some of which I had in hand and were doing, have been stopped and not re commenced. Why?

I have been sacked from my own profitable solvent company on the grounds of genuine redundancy which is simply not true. False allegations have been made about me. Why?”

David Gilbert Bankwest replied:

“You have requested a meeting with the Bank, and this can be facilitated. I intend to include the Chief Manager of Credit and Asset Management to also be present.

As the issues you are raising pertain largely to the Receivership issues, I also intend to invite the Receiver and Managers together with our Legal representatives to this proposed meeting.”

In an email I sent to David Gilbert Bankwest 9 Nov 2011 DOC 123 I raised concerns that the receivers had done nothing on certain items required to sell the property.

On 11 Nov 2011 DOC 10 I advised Bankwest Manager David Gilbert “There have been a number of serious false allegations made about me by Mark Englebert. These will be on the agenda. These allegations need to be cleared up….” I then requested further details and proof of these allegations. No details or proof were ever provided. These allegations are ALL FALSE.

I have raised my concerns regarding dishonest conduct by the receiver with Senior Bankwest Manager David Gilbert, Chris Butler and Les Nathan and others on numerous occasions.

In the documents the receiver returned to me in December 2015 there is further evidence Bankwest knew what was going on:

DOC 130 10.9.2012 Three Bankwest senior managers notes discussing Senate Inquiry:

“Suppress issue by not “feeding the media””

“3rd Party “umpire”? might have merit”

Bankwest Manager discussed using a 3rd party umpire… I had requested independent review and arbitration but they ignored my requests. I believe this is because if they had done so it would expose criminal conduct by some involved.

DOC 131 10.9.2012 Bankwest Senior Managers David Nolan, Les Nathan & David Gilbert:

“sink boots into customer”

“DN has info on Senators” (DN = David Nolan, Bankwest Manager)

This says it all. They produced a litany of lies to a Senate Inquiry and tried to keep it secret.

DOC 132 5.10.2012 Receivers notes:

“In camera. Confidential outcome” and “steer away from numbers”

They wanted it kept secret. There was no need for this if they have nothing to hide.